NATURAL GAS STORAGE

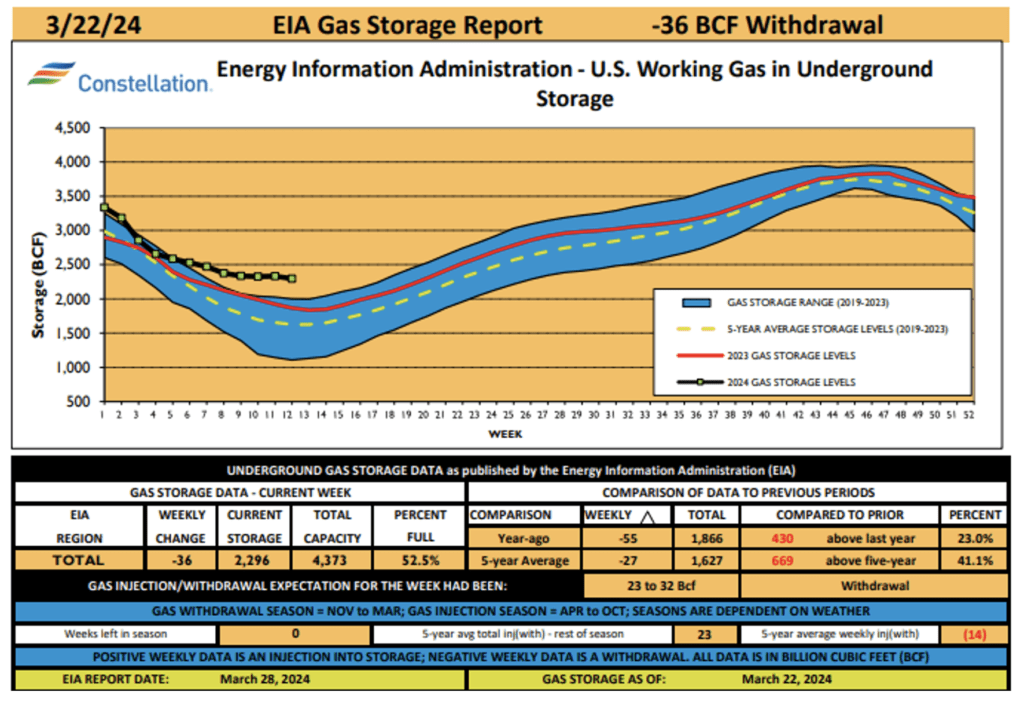

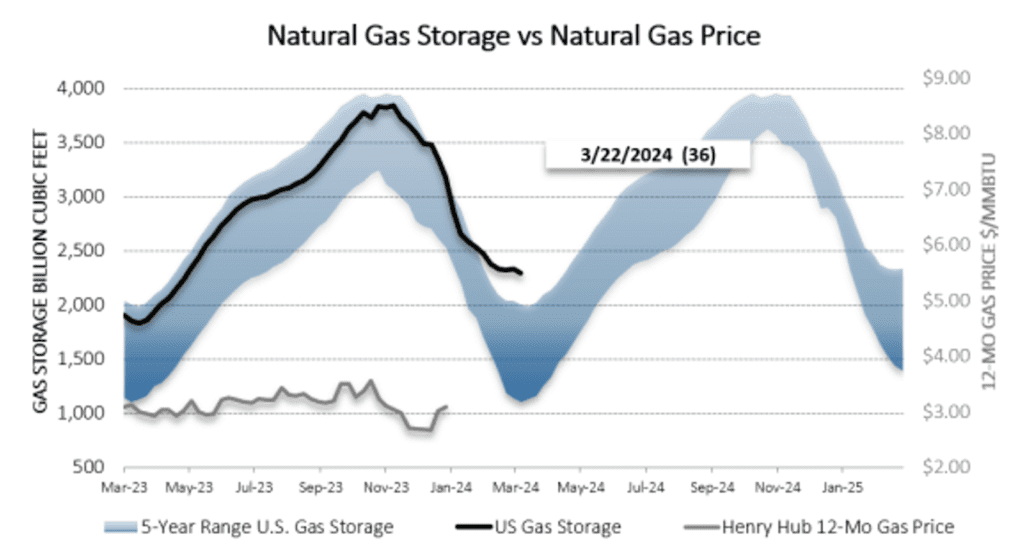

We are now in the injection season with a substantial +669 Bcf surplus over the five-year average. This surplus and robust oil production numbers will likely keep prices relatively stable, hovering within a dollar or two of these prices until at least next spring.

OUR GAS SURPLUS

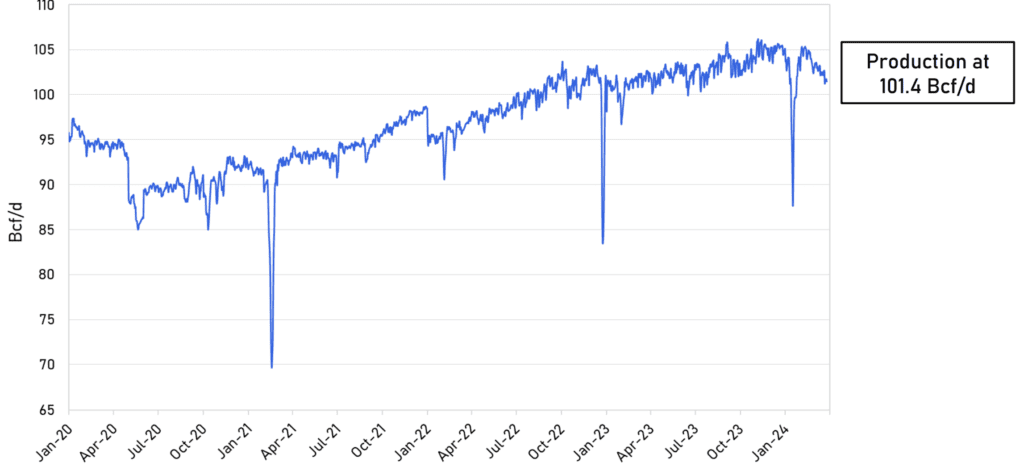

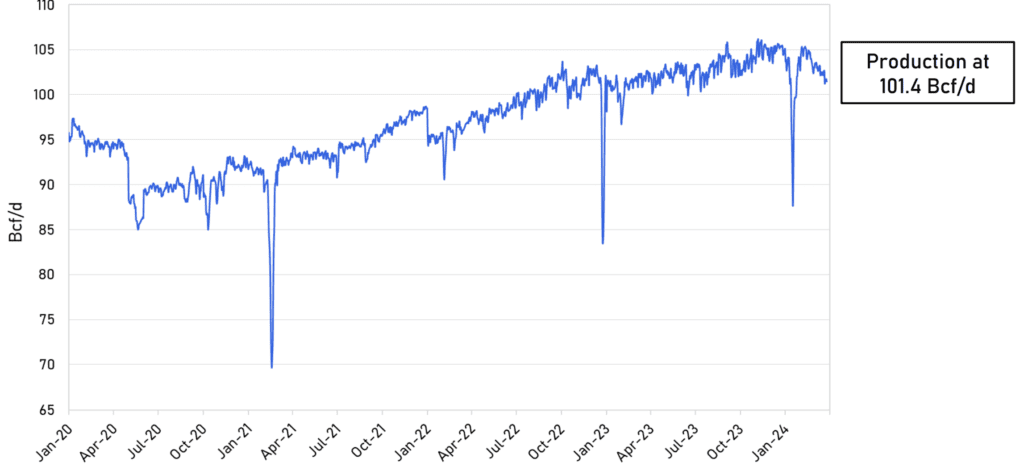

Production cuts are taking place now, and as long as pricing remains as low as it has been for the last few months, the cuts will continue until pricing becomes more profitable for gas producers. Multiple gas producers have announced cutbacks, and we have seen daily natural gas production drop from over 105 Bcf/d to 101.4 Bcf/d this last week.

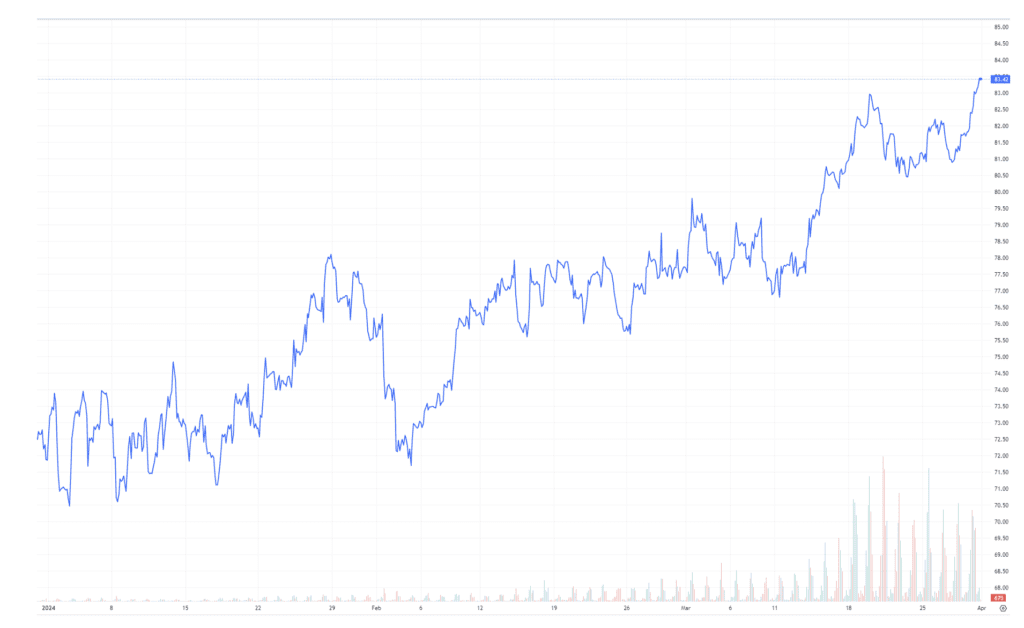

NYMEX CALENDAR STRIPS

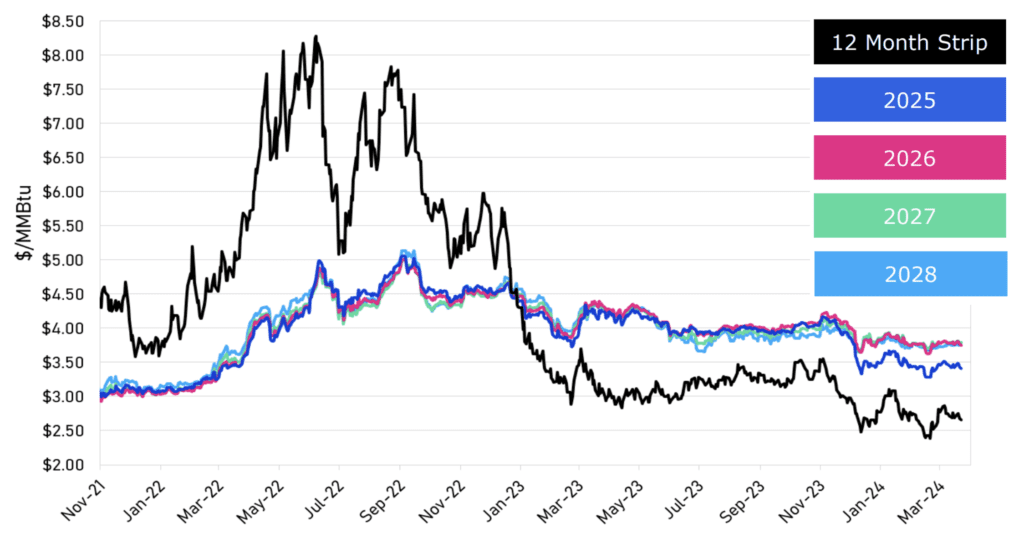

ALL ABOUT THE NYMEX TWELVE-MONTH STRIP

- The NYMEX Twelve Month Strip is the average of the upcoming 12 months of closing Henry Hub natural gas futures prices as reported on CME/NYMEX.

- A futures strip is the buying or selling of futures contracts in sequential delivery months traded as a single transaction.

- The NYMEX Twelve Month Strip can lock in a specific price for natural gas futures for a year with 12 monthly contracts connected into a strip.

- The average price of these 12 contracts is the particular price that traders can transact at, indicating the direction of natural gas prices.

- The price of the NYMEX Twelve Month Strip can show the average cost of the next twelve months’ worth of futures.

- The NYMEX Twelve Month Strip is also used to understand the direction of natural gas prices and to lock in a specific price for natural gas futures for a year.

NATURAL GAS PRODUCTION

The past winter has been the warmest for the lower 48 states, resulting in a significant decrease in demand and an abundance of supply. However, this trend may shift with a potentially high-demand summer this year, as the weakening El Nino could influence weather patterns in the coming months.

WTI OIL PRICING IN 2024

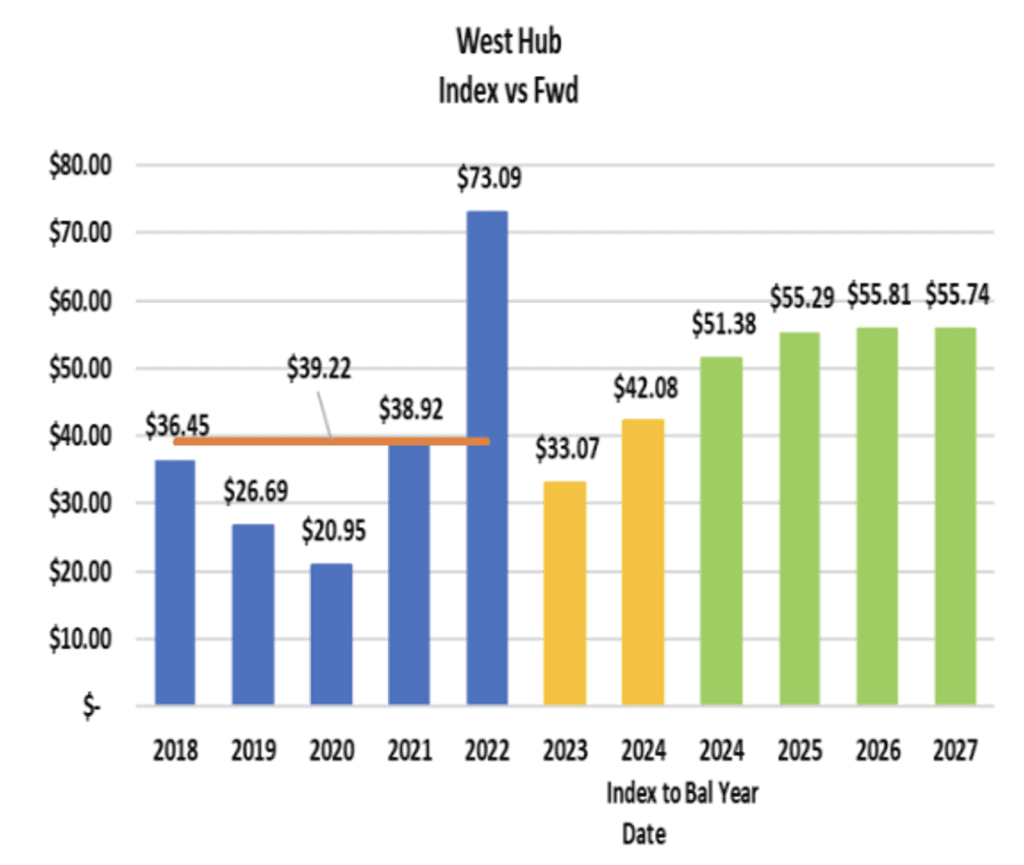

POWER PRICING PAST, PRESENT & FUTURE

Forward power pricing shows a sharp upward trend in the coming years. While past years have been lower, especially in 2020, future years out through 2027 show pricing $20.00 higher per MWh than in 2024.

Opportunities and swings will allow clients on a layered hedging strategy to buy at lower pricing. There may be better strategies than fixing future years for larger clients. Talk to them about block & index and setting up the framework to buy blocks of energy now when the market dips lower.

ANNOTATED PROMPT MONTH PRICING WITH NOTABLE EVENTS

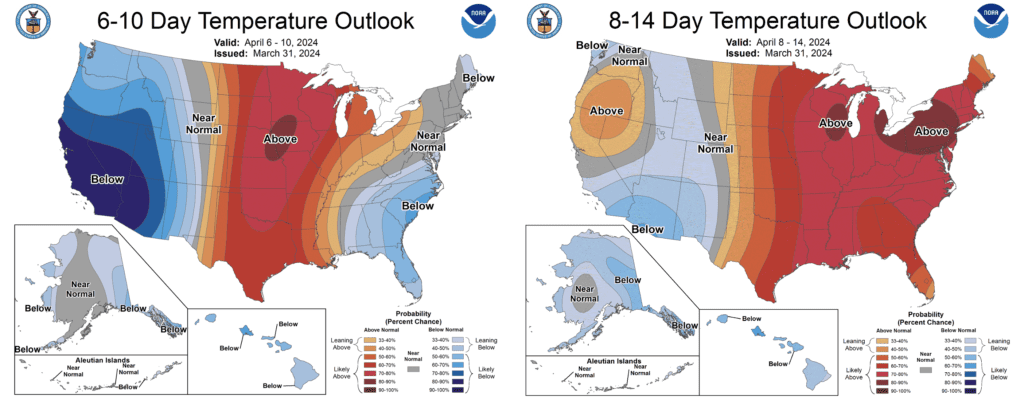

6-10 DAY AND 8-14 DAY OUTLOOK

Get ready for a pleasant start to the week across the US, with temperatures ranging from the upper 40s to the 80s. Although there might be some scattered showers, they shouldn’t dampen the comfortable conditions.

However, things will cool down as we move into the latter part of the week and the upcoming weekend. A weather system heading across the central US towards the East will bring rain and even some snow in some areas. Expect temperatures to drop to the 30s to 50s during the day and the 10s to 30s at night.

What to expect: The beginning of the week will see moderate demand for heating or cooling, but towards the end of the week and into the weekend, you might want to be prepared for stronger demands to stay warm.