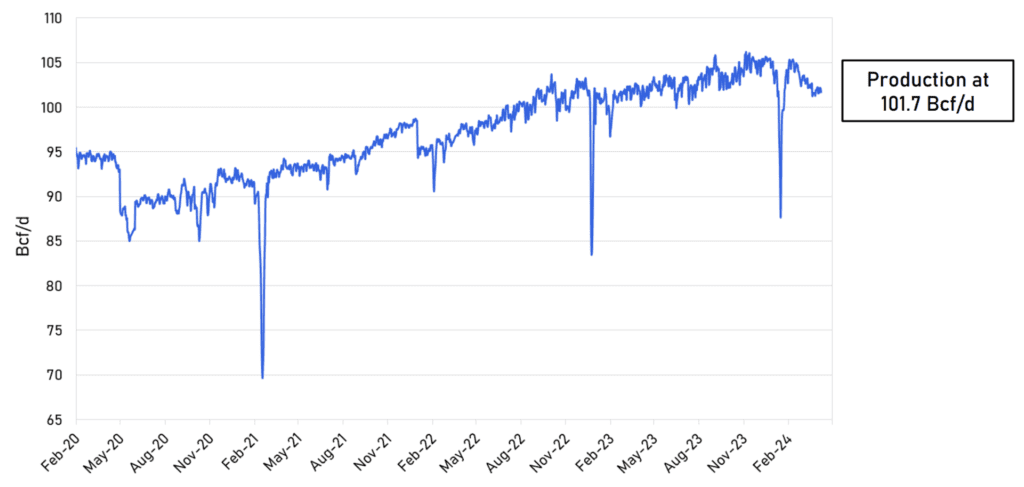

NATURAL GAS PRODUCTION

The Natural Gas Market remained essentially unchanged. Weakening weather demand and inconsistent LNG demand allowed pricing to stay low, and even production jumped about 2 Bcf/d last week to quash any chance of a market rally that would see significant price increases.

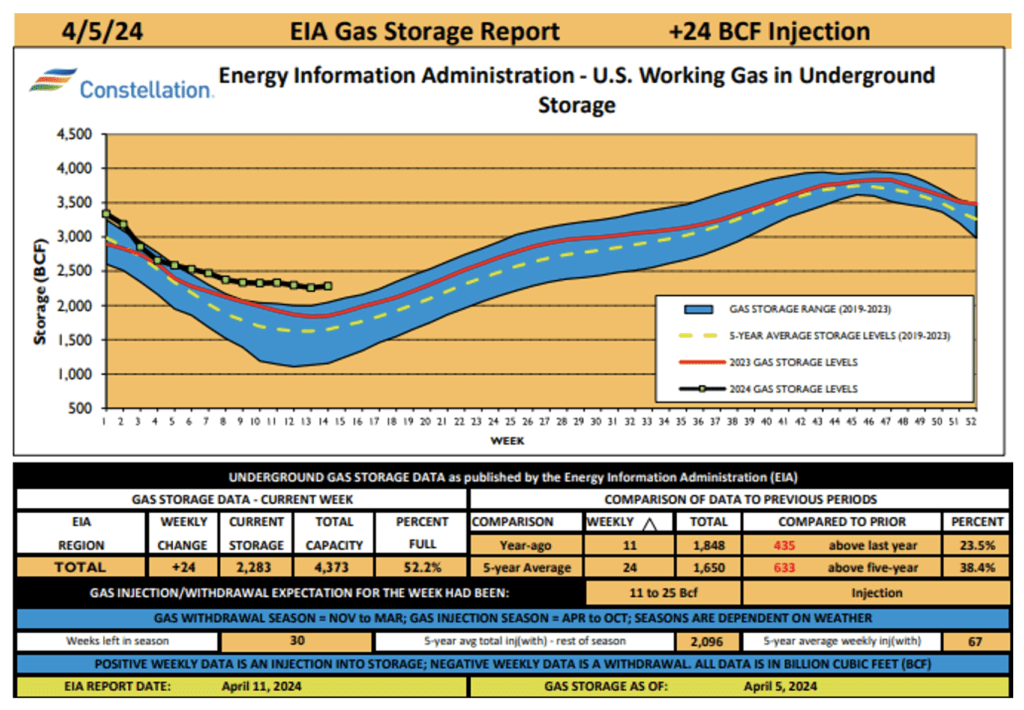

EIA NATURAL GAS STORAGE

Weather demand petered out the previous week, which meant we had a +24 Bcf injection instead of a projected withdrawal. This news should only further gas producers’ efforts to cut back on drilling. We currently have a surplus of more than 600 Bcf of natural gas over the five-year average coming out of the withdrawal season.

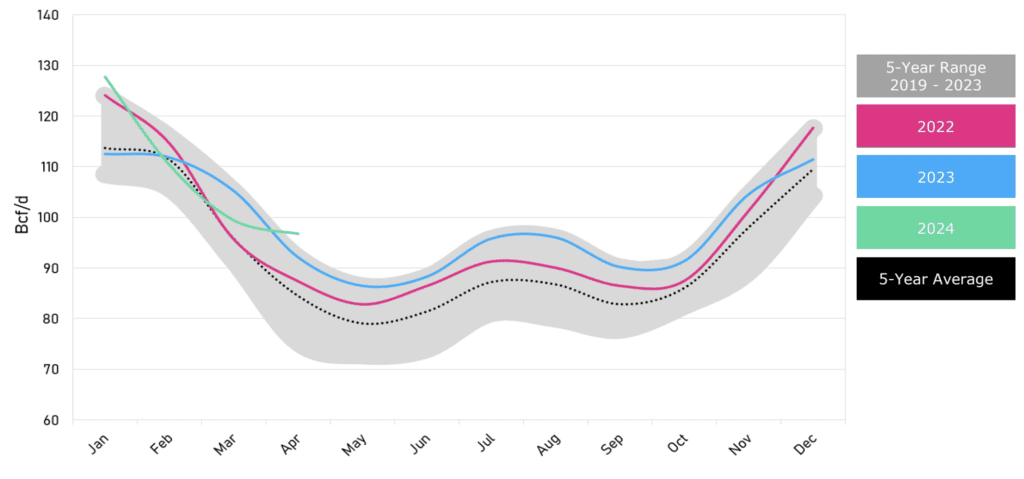

TOTAL NATURAL GAS DEMAND WITH EXPORTS

While weather-related demand was down, overall natural gas demand for all areas, plus exports, has far exceeded last year’s and the five-year average, surpassing the five-year range. This can be chalked up to a growing economy and declining exports. LNG exports have fallen by 2 Bcf in the last few weeks.

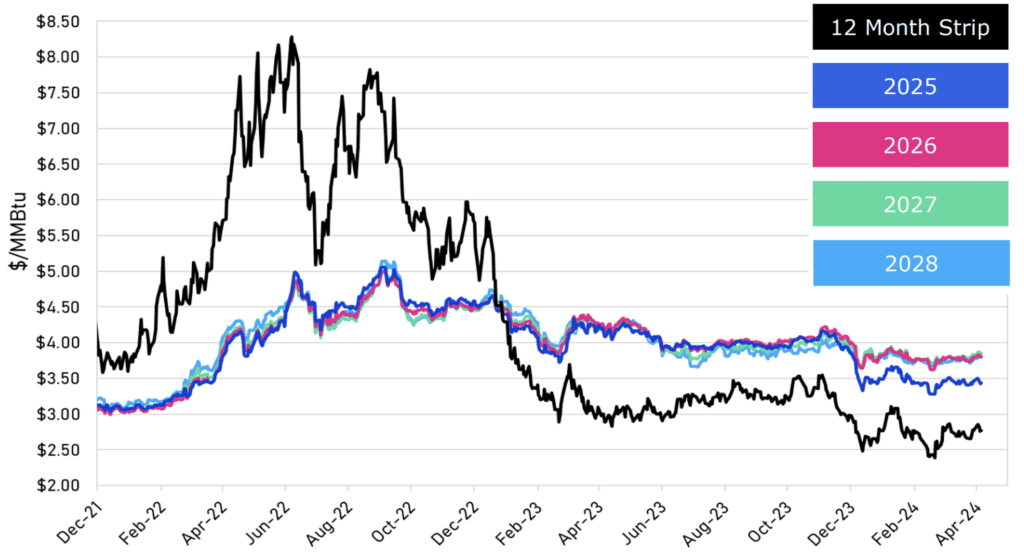

NYMEX CALENDAR STRIPS

As gas pricing in 2025 approaches 2024 levels, it’s prudent to consider a layered hedging strategy for your electricity, which is significantly influenced by gas prices. By setting up this framework now, you can strategically purchase different blocks of energy in advance or during market dips. This approach not only helps to mitigate risk but also reduces the premiums you would pay on a fixed all-in rate, including pricing for future years that suppliers have to hedge against.

ALL ABOUT THE NYMEX TWELVE-MONTH STRIP

- The NYMEX Twelve Month Strip is the average of the upcoming 12 months of closing Henry Hub natural gas futures prices as reported on CME/NYMEX.

- A futures strip is the buying or selling of futures contracts in sequential delivery months traded as a single transaction.

- The NYMEX Twelve Month Strip can lock in a specific price for natural gas futures for a year with 12 monthly contracts connected into a strip.

- The average price of these 12 contracts is the particular price that traders can transact at, indicating the direction of natural gas prices.

- The price of the NYMEX Twelve Month Strip can show the average cost of the next twelve months’ worth of futures.

- The NYMEX Twelve Month Strip is also used to understand the direction of natural gas prices and to lock in a specific price for natural gas futures for a year.

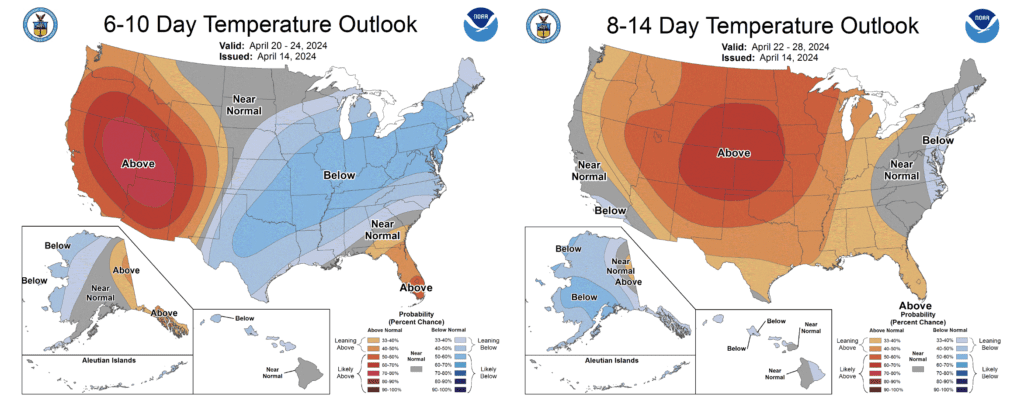

6-10 DAY AND 8-14 DAY OUTLOOK

Temperatures will be pretty comfortable over the northern US, with highs in the 50s to near 70°F. The southern US will see very nice to warm weather, with highs in the 60s to 80s and some local areas reaching the 90s. The weather across the US will be very nice, with highs ranging from the 50s to 80s.

Natural Gas Demand Forecast: Light to very light demand is expected over the next seven days.

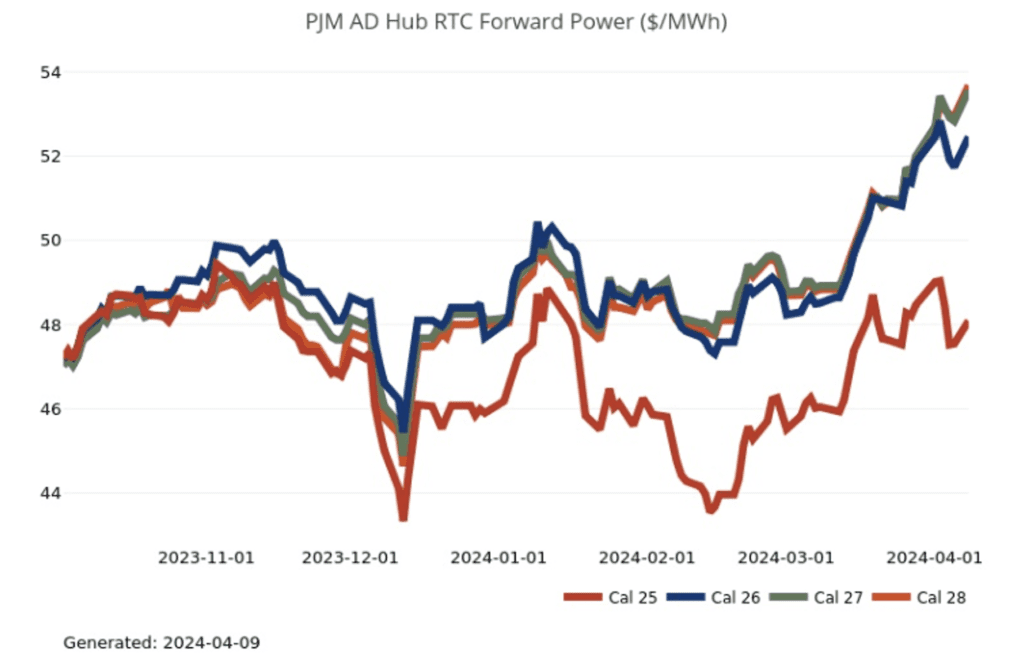

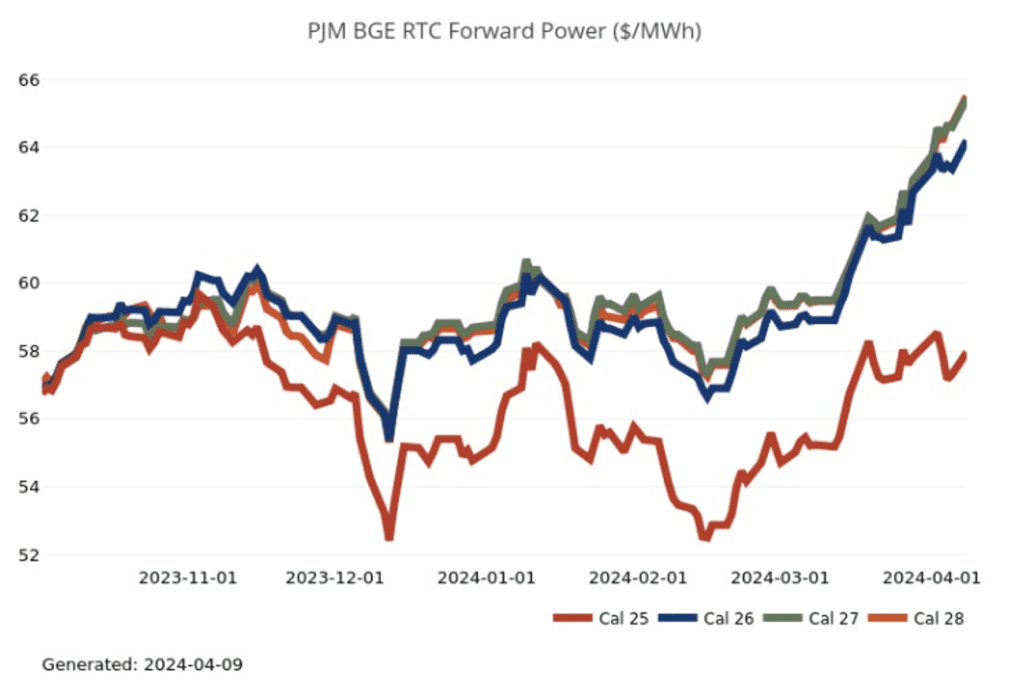

ELECTRICITY: FORWARD POWER PRICES

PJM AD HUB FORWARD POWER PRICES

PJM BGE HUB FORWARD POWER PRICES

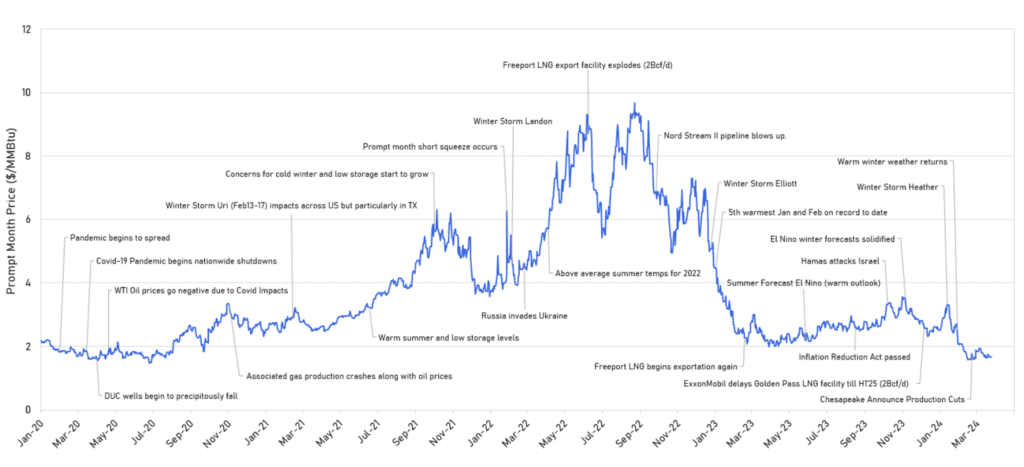

ANNOTATED PROMPT MONTH PRICING WITH NOTABLE EVENTS