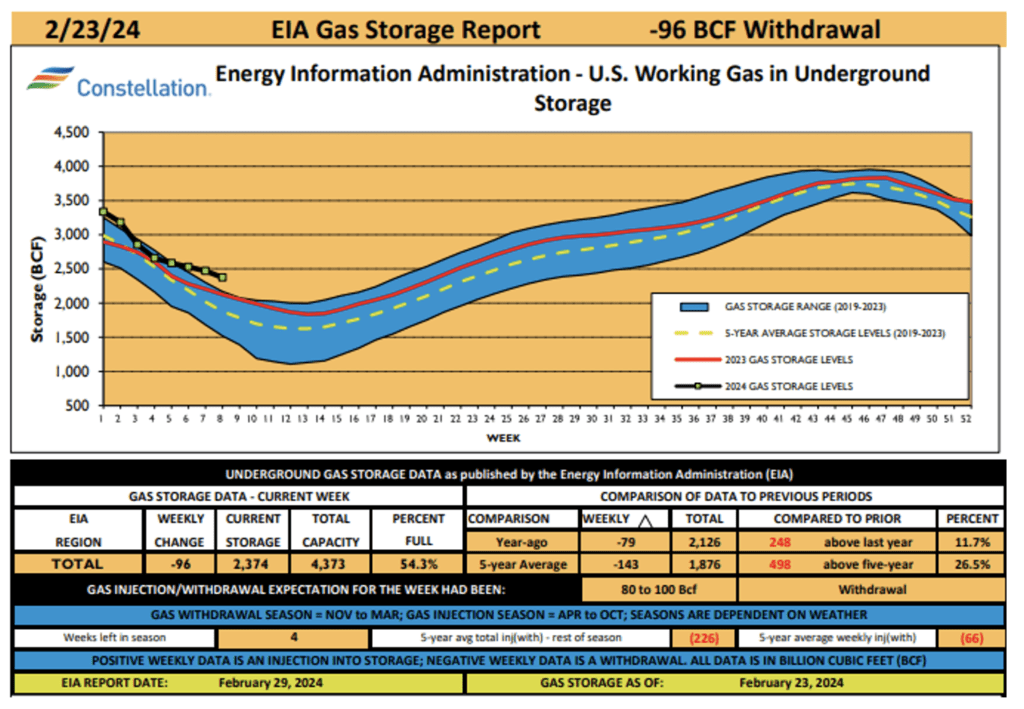

NATURAL GAS STORAGE

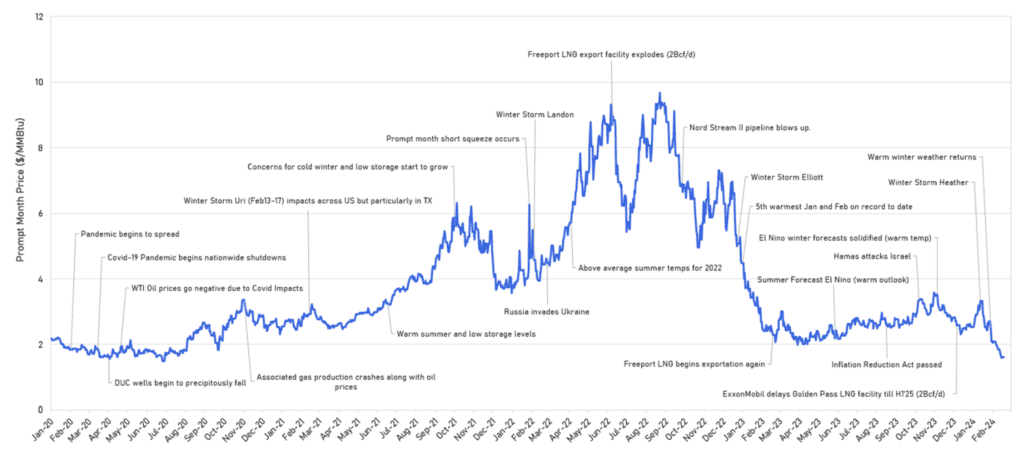

The weather continues to be historically mild, with only occasional upticks that get erased quickly. There is no guarantee that next winter will continue to have record-breaking mild winters, and betting that we will continue to break the record for mild winters every year as we have the last two is a good way to get caught short when your contract expires.

So far this year, we have had smaller withdrawals than last year and the five-year average in all eight weekly storage reports in 2024. With only three weeks left in withdrawal season, we will begin the official injection season on April 1st with higher demand but higher production and more gas in storage than last year and the five-year average.

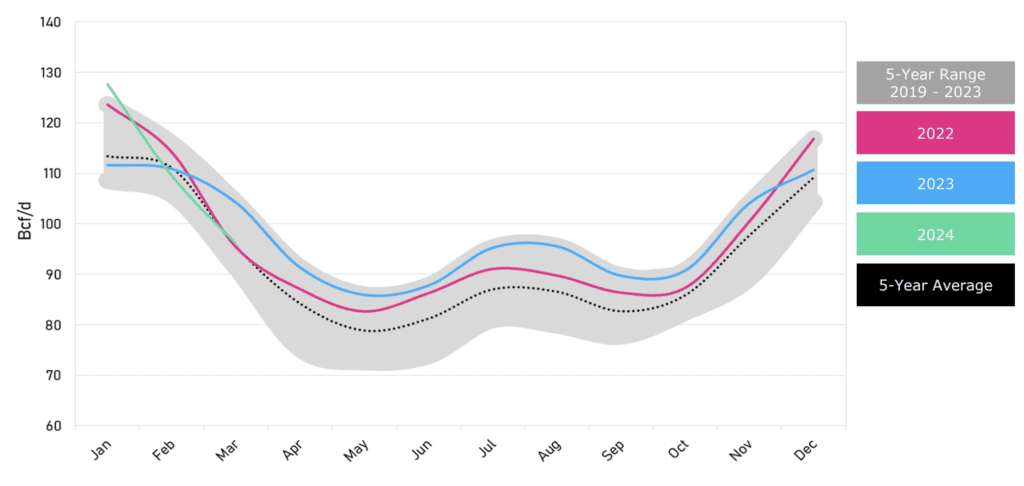

TOTAL NATURAL GAS DEMAND WITH EXPORTS

•Not only will export facilities increase our LNG exports by about another 10 Bcf/d, but European demand could also rise dramatically. They have had two mild winters in a row and have the same fear we have of a colder winter, which cannot be predicted. Those increased exports will come from domestic production, leaving less gas in storage.

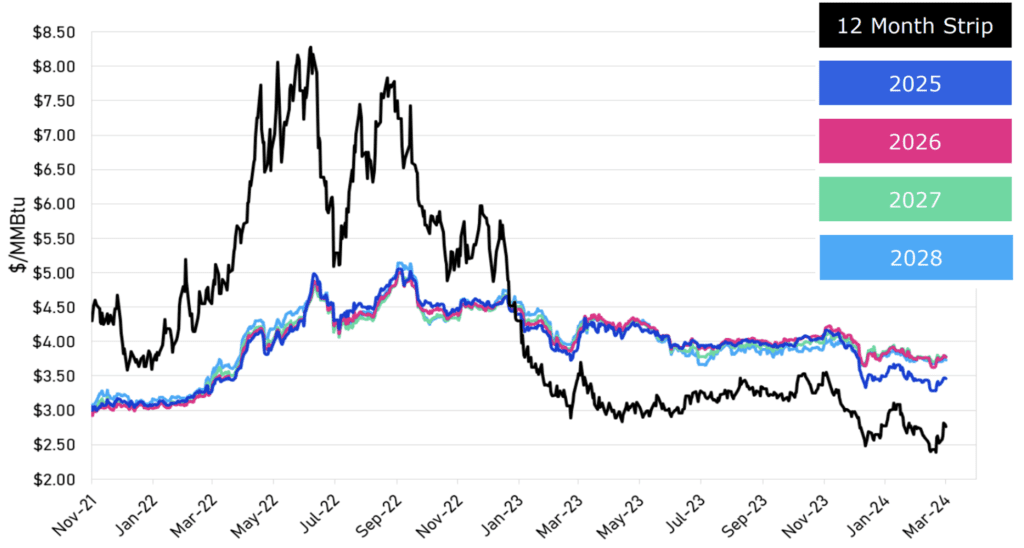

NYMEX CALENDAR STRIPS

All the risk is upside. Last month’s NYMEX settlement price of $1.61 is lower than every month except July 2020 in the heart of the pandemic. There is little room for it to go lower. However, any major event, weatherwise, geopolitically, or just production cutbacks, could send the market much higher than it currently is. Don’t gamble dollars away on pennies.

ALL ABOUT THE NYMEX TWELVE-MONTH STRIP

- The NYMEX Twelve Month Strip is the average of the upcoming 12 months of closing Henry Hub natural gas futures prices as reported on CME/NYMEX.

- A futures strip is the buying or selling of futures contracts in sequential delivery months traded as a single transaction.

- The NYMEX Twelve Month Strip can lock in a specific price for natural gas futures for a year with 12 monthly contracts connected into a strip.

- The average price of these 12 contracts is the particular price that traders can transact at, indicating the direction of natural gas prices.

- The price of the NYMEX Twelve Month Strip can show the average cost of the next twelve months’ worth of futures.

- The NYMEX Twelve Month Strip is also used to understand the direction of natural gas prices and to lock in a specific price for natural gas futures for a year.

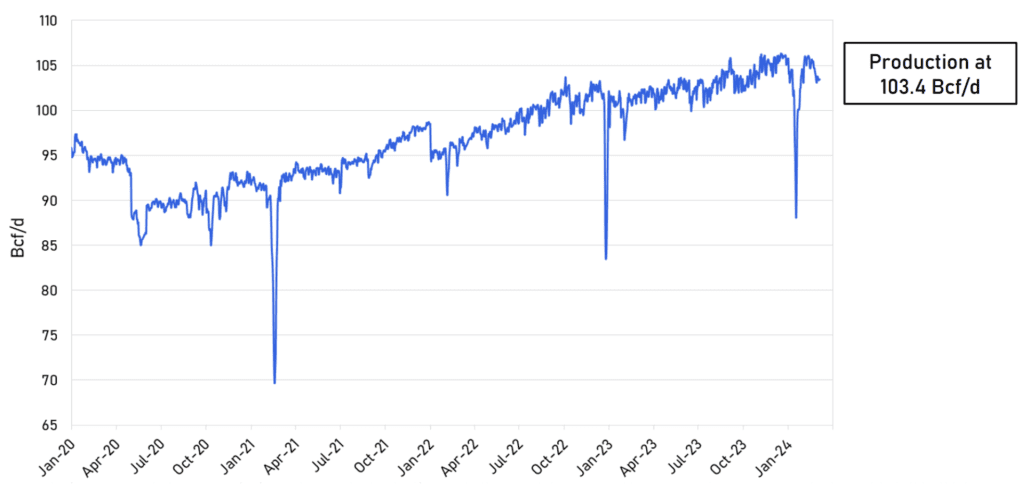

TOTAL NATURAL GAS PRODUCTION

Gas production has fallen for the second straight week, down to just over 103 bcf a day, but our storage surpluses over the five-year average are so significant that it should not make much difference. With a mild April and May expected, this could bring pricing down in the long term after we get past this small cold front over the next couple of weeks.

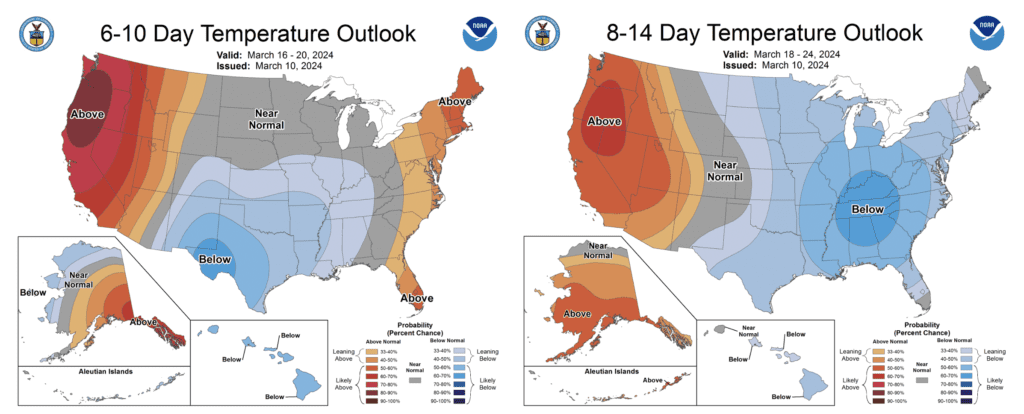

WEATHER: 6-10 DAY AND 8-14 DAY OUTLOOK

A slight cooling trend over the next couple of weeks will increase demand for northern states, which may lead to an increase in pricing. The increase will not be significant and may only be temporary, but be on the lookout for slightly higher pricing.

Weather Outlook: March 11-17

- West Coast & New England: Expect rainy and snowy conditions with temperatures ranging from the 40s to 60s.

- Interior and Southern US: Mostly pleasant weather with temperatures ranging from the 50s to 80s, thanks to high pressure dominating the area.

- Overall Demand: Low today, then very low from Tuesday to Saturday.

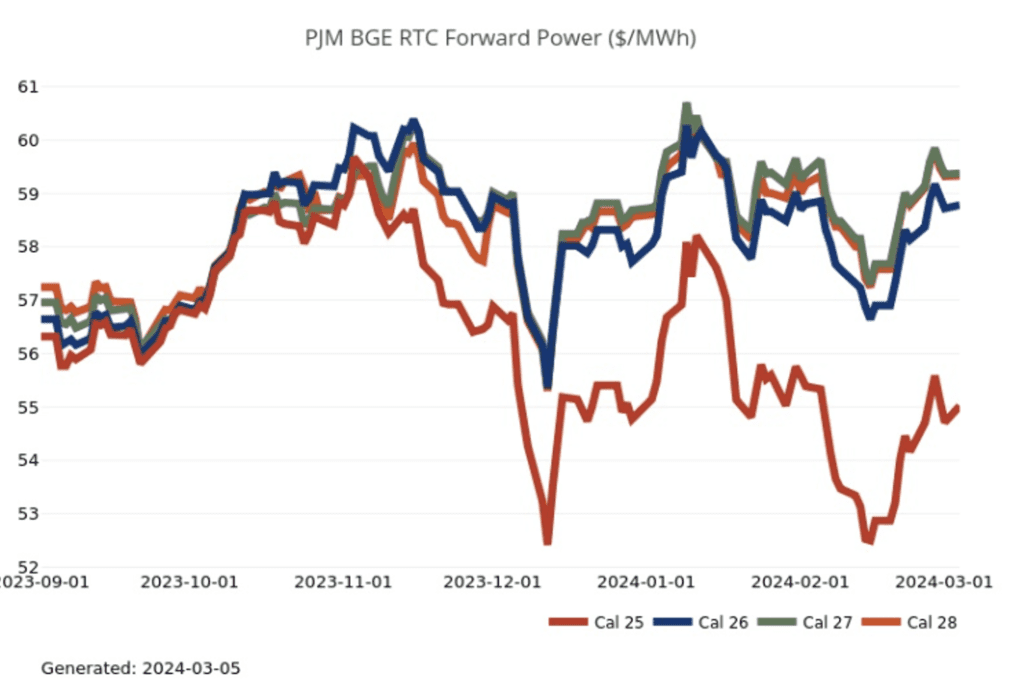

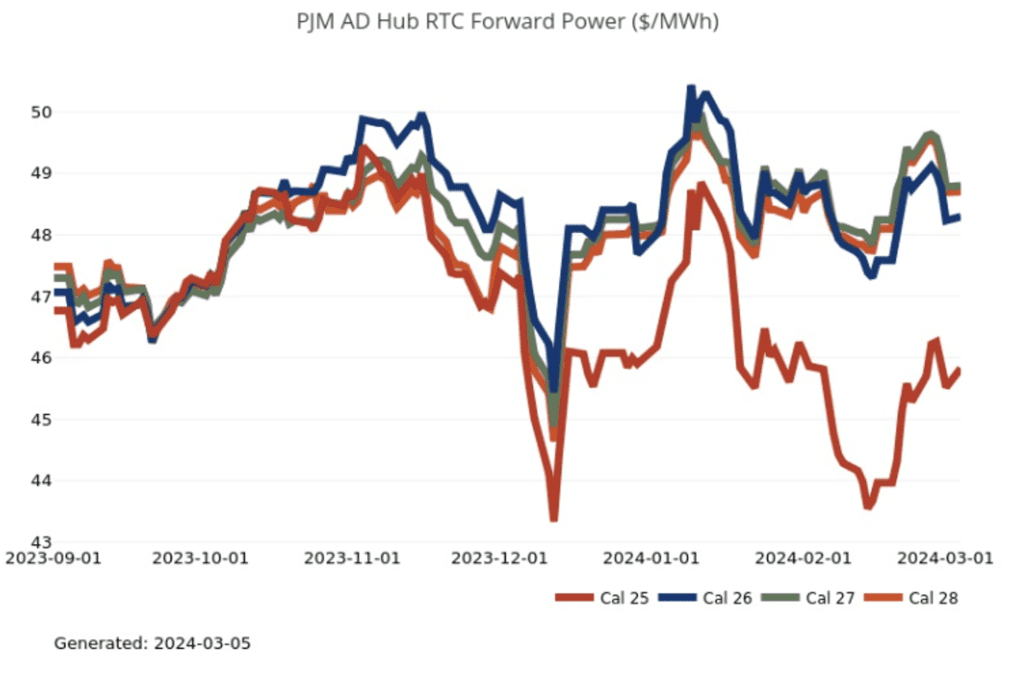

FORWARD POWER PRICES

Electricity Pricing has been very favorable over the last few months, with 2024 rolling near $46.00 per Mcf in the AD HUB and $55.00 in the BGE Hub. The mild weather should dampen pricing over the next two to three months as we prepare for temperatures warm enough to shut off the heaters but not yet hot enough to need the air conditioning turned on.

ANNOTATED PROMPT MONTH PRICING WITH NOTABLE EVENTS