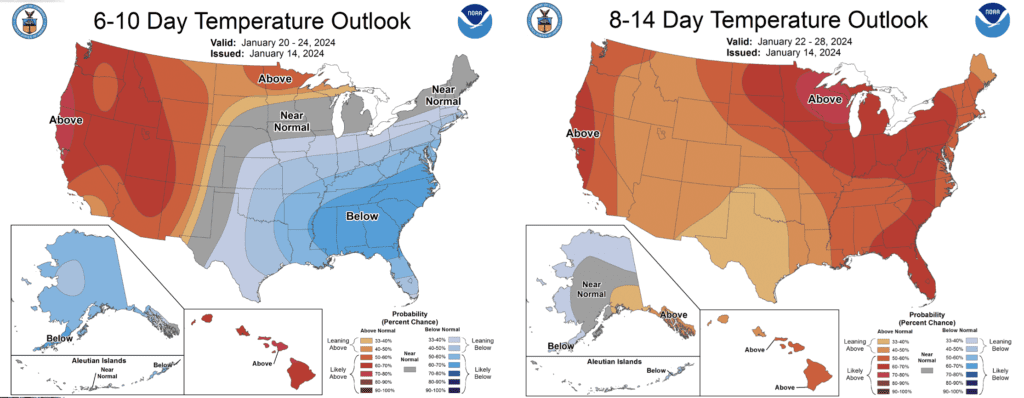

WEATHER: 6-10 DAY AND 8-14 DAY OUTLOOK

The current wave of freezing temperatures has sent the market northward over $3.00. Freezing temperatures have increased demand and likely caused well-head freeze-offs that have hurt production. The good news is that another warmer front will follow the cold front with warmer temperatures across the country in the next 10-14 days.

U.S. natural gas output fell to a preliminary 11-month low on Sunday as frigid weather froze wells across the country, while gas demand for heating and power generation was on track to hit record highs.

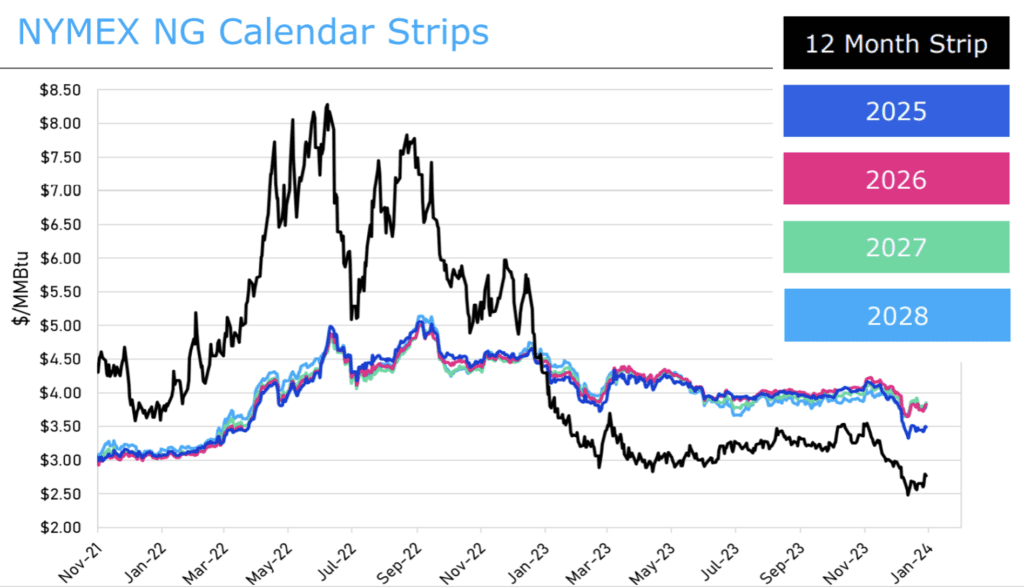

NYMEX CALENDAR STRIPS

The prompt month gas market on the NYMEX saw pricing drop to $2.19 in early-mid December based on high production and mild weather. Since December 12, 2023, the market rose $ 1.56 on colder forecasts. However, the market did drop 0.18 cents on news of a warm front to follow.

ALL ABOUT THE NYMEX TWELVE-MONTH STRIP

- The NYMEX Twelve Month Strip is the average of the upcoming 12 months of closing Henry Hub natural gas futures prices as reported on CME/NYMEX.

- A futures strip is the buying or selling futures contracts in sequential delivery months traded as a single transaction.

- The NYMEX Twelve Month Strip can lock in a specific price for natural gas futures for a year with 12 monthly contracts connected into a strip.

- The average price of these 12 contracts is the particular price that traders can transact at, indicating the direction of natural gas prices.

- The price of the NYMEX Twelve Month Strip can show the average cost of the next twelve months’ worth of futures.

- The NYMEX Twelve Month Strip is also used to understand the direction of natural gas prices and to lock in a specific price for natural gas futures for a year.

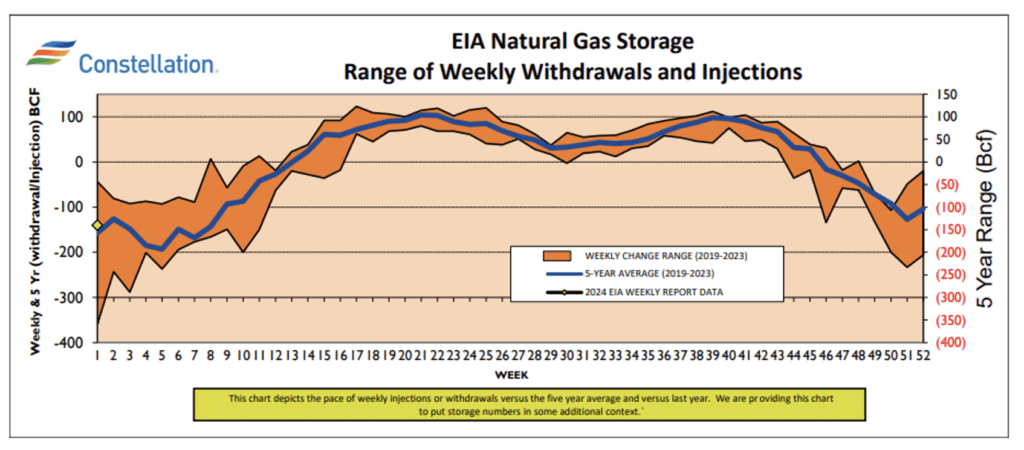

EIA: NATURAL GAS STORAGE

Production was back up to 105 Bcf last week, continuing the streak of near-record gas production. Production has been helped along by the record amount of oil production we have seen. Natural Gas is often a byproduct of oil drilling. This gas production is called Associated Natural Gas Production.

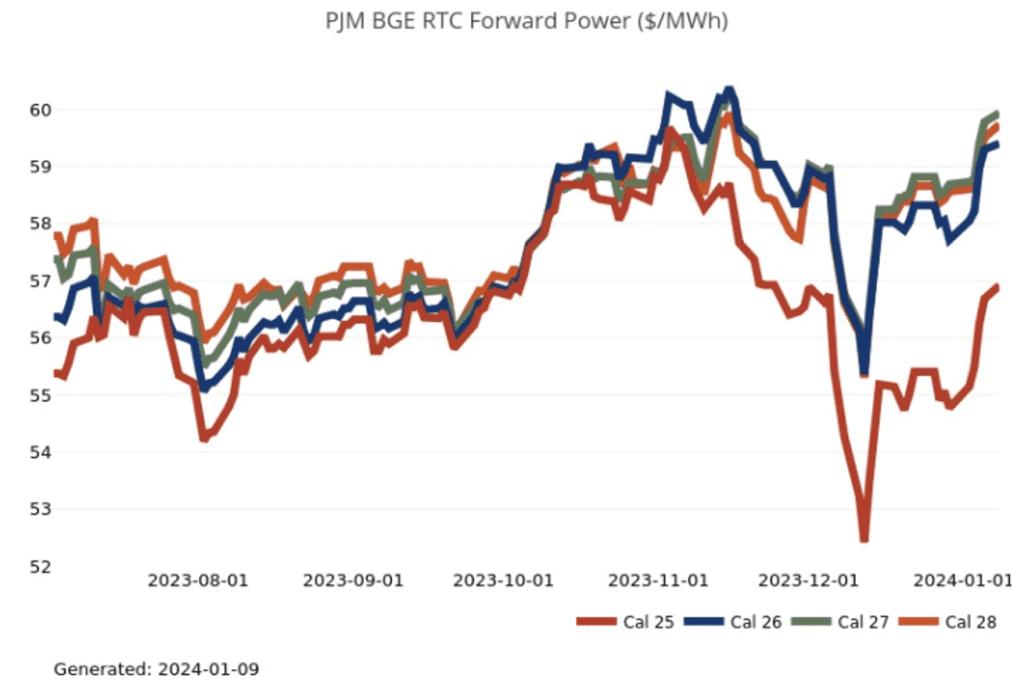

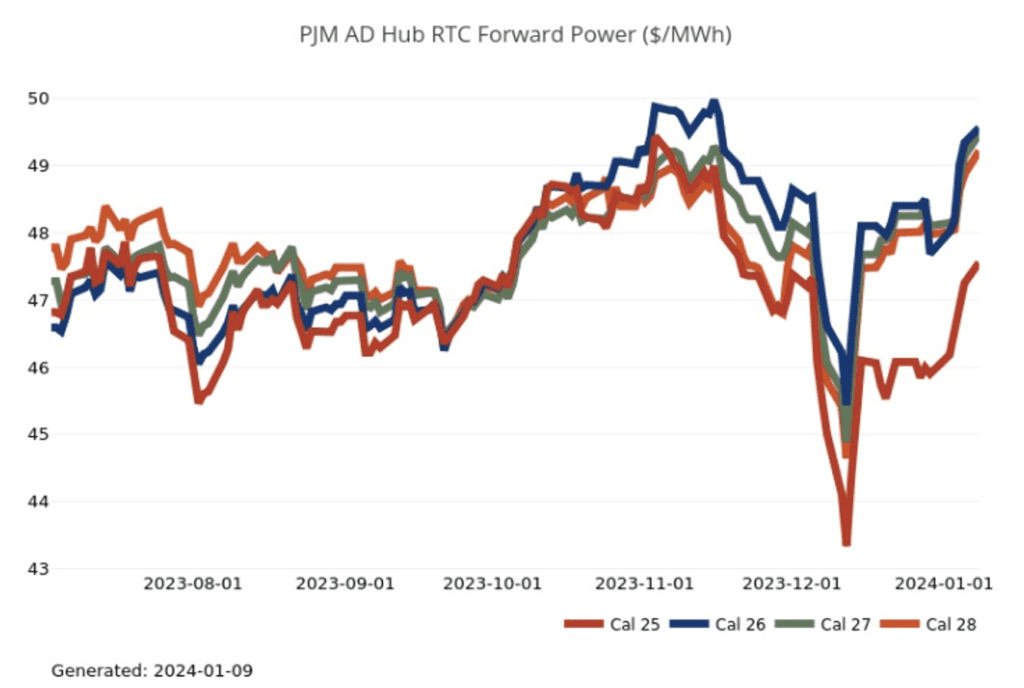

FORWARD POWER PRICING

The rising cost of Natural Gas has also had a volatile effect on the electricity market. In the AD Hub, pricing has risen more than $4.00 a MWh; in the BGE Hub, electricity pricing has risen from $52.00 MWh to $57.00 MWh.

BGE FORWARD POWER PRICING

ADHUB FORWARD POWER PRICING

WHAT IS FORWARD POWER PRICING?

Forward power pricing is a financial mechanism used in the energy industry, particularly in the electricity market. It involves the pricing and trading of electricity for future delivery at a predetermined price. This mechanism allows electricity producers, consumers, and traders to hedge against price fluctuations in the electricity market and manage their risk exposure.

HENRY HUB NATURAL GAS VS AD HUB ELECTRICITY PRICING

ALL ABOUT THE HENRY HUB:

The Henry Hub is a natural gas pipeline hub in Erath, Louisiana, USA. It is a significant delivery hub for natural gas futures traded on the New York Mercantile Exchange (NYMEX). The prices of natural gas futures contracts traded at the Henry Hub are widely used as a benchmark for natural gas pricing in the United States.

The hub is named after Henry, a small community in Louisiana where several interstate and intrastate natural gas pipelines converge. It has become a key reference point for the pricing of natural gas in North America, and the Henry Hub, natural gas futures contract, is one of the world’s most actively traded energy derivatives.