URGENT REASONS TO BUY NOW:

LOWER SUPPLY

- Our production is dwindling. After upwards of 105-106 Bcf/d, we are now producing barely 100 Bcf/d.

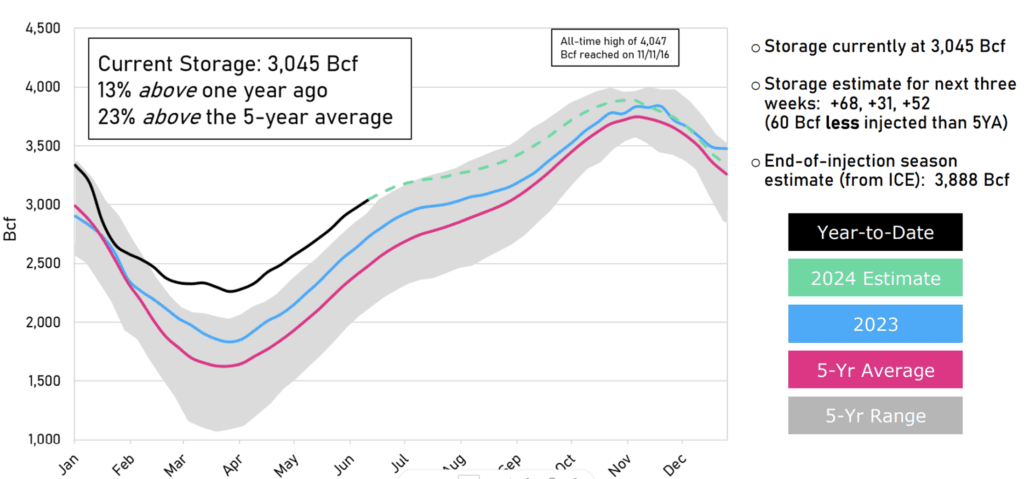

- The 20% surplus we once enjoyed last year (29% over the five-year average) is now down to 13% and 23% and will likely dwindle to almost nothing by the onset of Winter 2025.

LNG DEMAND

- LNG Exports are slowly climbing again after Freeport LNG fixed their three trains, and they are now near total capacity.

- The Plaquemines LNG facility has begun to take in natural gas to be converted and will start exporting in the coming months. When both phases are done, they can export up to 3.0-3.4 Bcf/d.

- Combined with Mexican pipeline exports, the U.S. will export upwards of 20 bcf daily by the end of 2025. Right around the corner.

WEATHER DEMAND

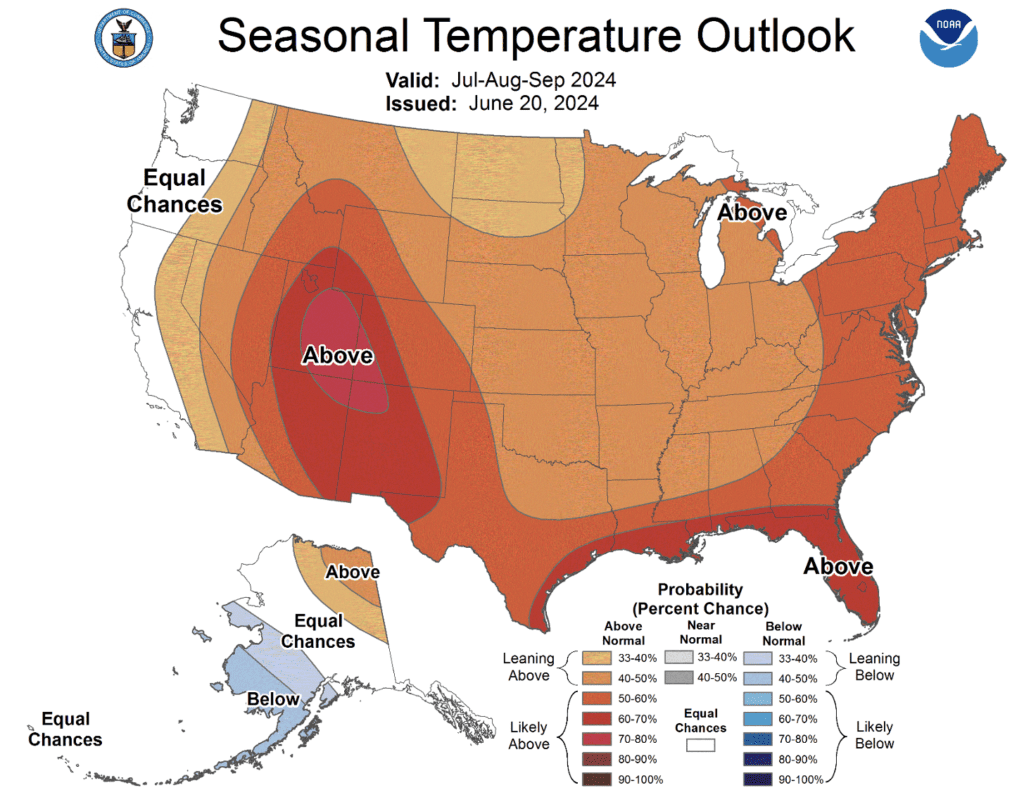

2023 set a new record for summer heat, and 2024 is expected to be up there. We already had heat demand warning days in mid-June, which technically is not even summer. All ten of the top ten hottest summers in recorded history have been in this century, and this summer will be no different.

WEATHER: OUTLOOK

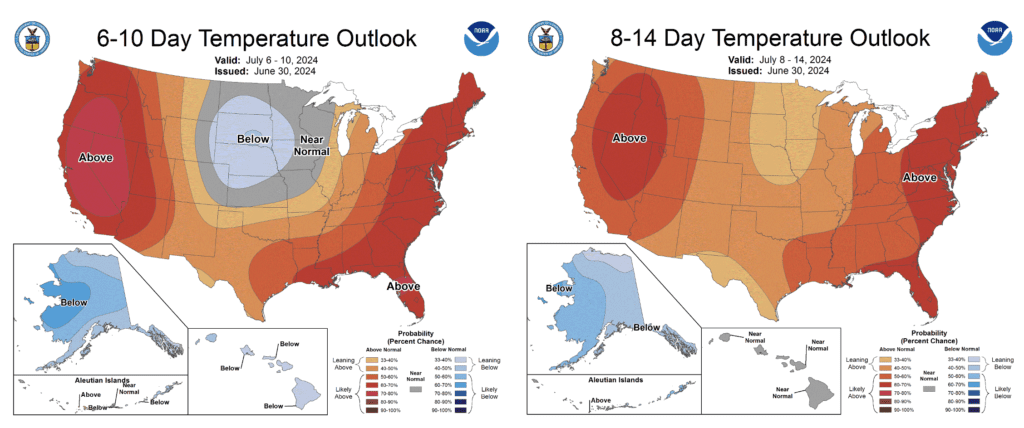

Weather Forecast: July 1-7

Southern United States (2/3 of the country)

- Dominated by a robust high-pressure system

- Hot temperatures prevail

- Highs mainly in the 90s and 100s Fahrenheit

Northern United States (1/3 of the country)

- Pleasant to warm conditions

- Highs generally in the 70s and 80s Fahrenheit

- Some local areas may experience hotter temperatures in the 90s

Overall Outlook

- Expect high to very high energy demand across the country

- Southern regions will likely see higher energy consumption due to increased cooling needs

This week’s weather pattern divides the hot southern regions and the milder northern areas, with most of the country experiencing above-average temperatures.

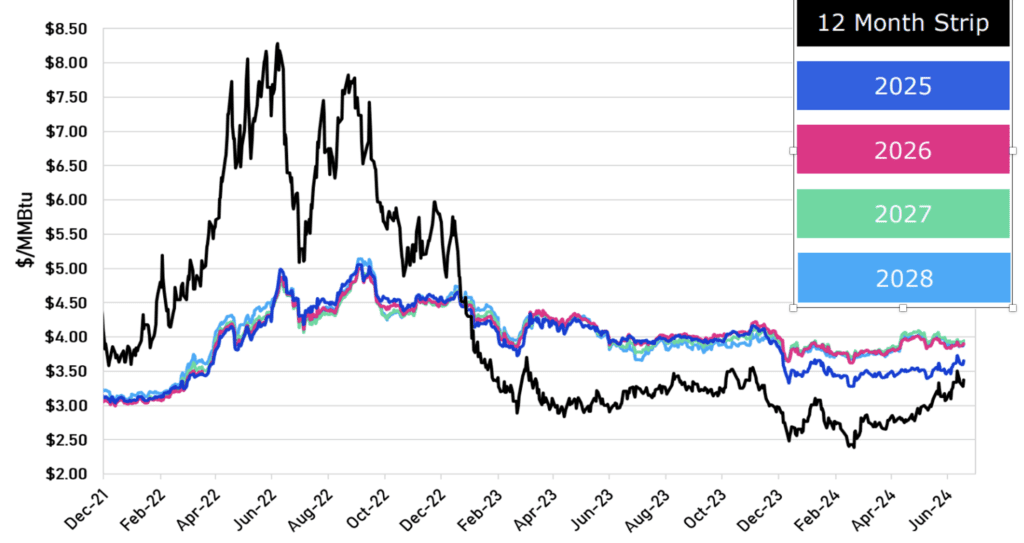

NYMEX NATURAL GAS CALENDAR STRIPS

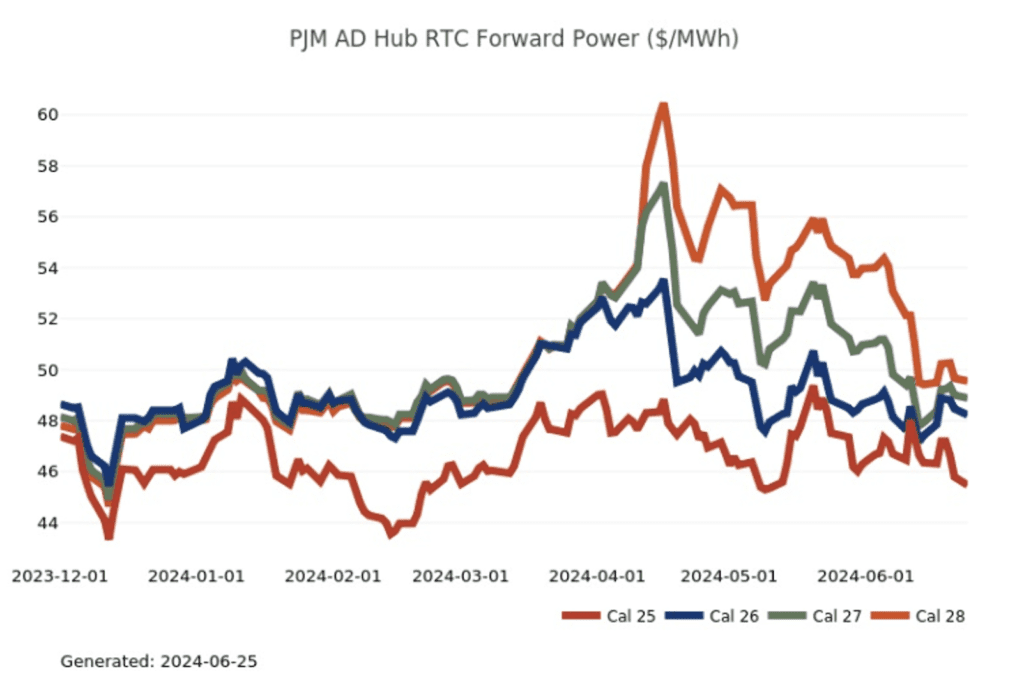

PJM AD HUB FORWARD POWER CURVE